Mclean County Il Property Tax Rate . mclean county (2.31%) has a 9.5% higher property tax rate than the average of illinois (2.11%). the median property tax (also known as real estate tax) in mclean county is $3,076.00 per year, based on a median home value. Mclean county is rank 12th out. mclean county makes every effort to produce and publish the most current and accurate information possible. What role does property tax play?. tax rate which is the amount of tax due in terms of a percentage of the tax base is calculated by the county clerk's office. the mclean county collector’s office collects over $431 million in property taxes from approximately 68,000 parcels. follow the link below to an overview of property taxes that will answer questions like: to use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase.

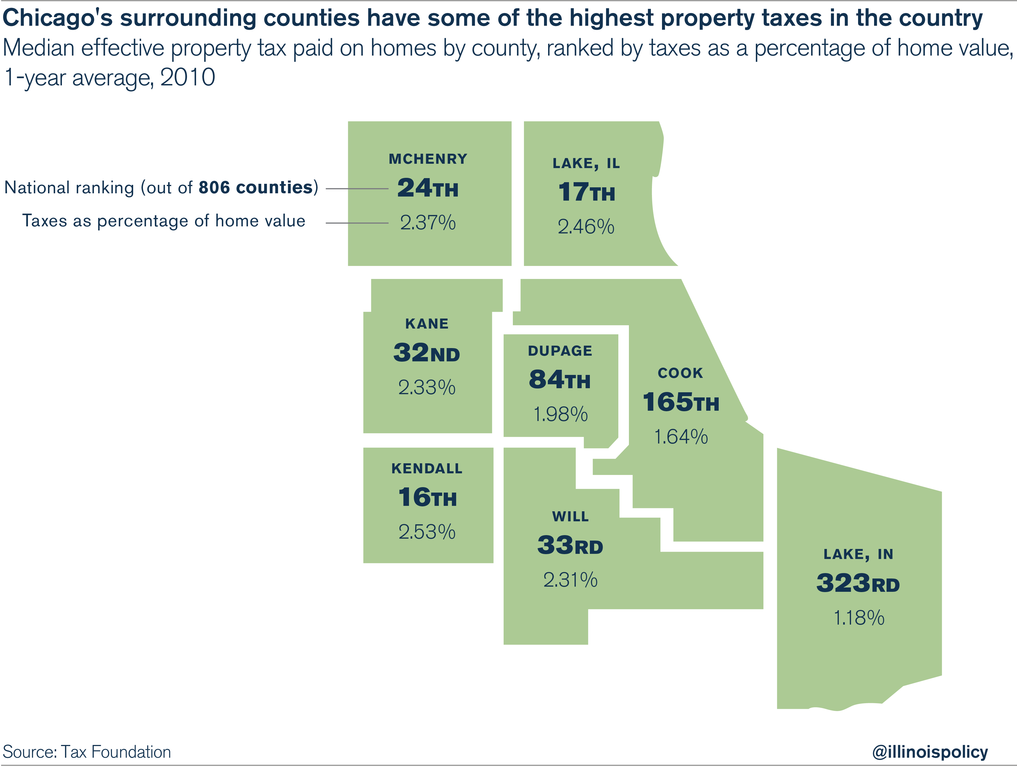

from www.illinoispolicy.org

follow the link below to an overview of property taxes that will answer questions like: Mclean county is rank 12th out. What role does property tax play?. tax rate which is the amount of tax due in terms of a percentage of the tax base is calculated by the county clerk's office. the mclean county collector’s office collects over $431 million in property taxes from approximately 68,000 parcels. mclean county makes every effort to produce and publish the most current and accurate information possible. the median property tax (also known as real estate tax) in mclean county is $3,076.00 per year, based on a median home value. mclean county (2.31%) has a 9.5% higher property tax rate than the average of illinois (2.11%). to use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase.

The Chicago squeeze Property taxes, fees and over 30 individual taxes

Mclean County Il Property Tax Rate mclean county makes every effort to produce and publish the most current and accurate information possible. mclean county makes every effort to produce and publish the most current and accurate information possible. Mclean county is rank 12th out. What role does property tax play?. mclean county (2.31%) has a 9.5% higher property tax rate than the average of illinois (2.11%). follow the link below to an overview of property taxes that will answer questions like: tax rate which is the amount of tax due in terms of a percentage of the tax base is calculated by the county clerk's office. the mclean county collector’s office collects over $431 million in property taxes from approximately 68,000 parcels. the median property tax (also known as real estate tax) in mclean county is $3,076.00 per year, based on a median home value. to use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing Mclean County Il Property Tax Rate Mclean county is rank 12th out. tax rate which is the amount of tax due in terms of a percentage of the tax base is calculated by the county clerk's office. mclean county makes every effort to produce and publish the most current and accurate information possible. What role does property tax play?. mclean county (2.31%) has. Mclean County Il Property Tax Rate.

From www.mapsales.com

McLean County, IL Wall Map Color Cast Style by MarketMAPS Mclean County Il Property Tax Rate mclean county (2.31%) has a 9.5% higher property tax rate than the average of illinois (2.11%). Mclean county is rank 12th out. the median property tax (also known as real estate tax) in mclean county is $3,076.00 per year, based on a median home value. the mclean county collector’s office collects over $431 million in property taxes. Mclean County Il Property Tax Rate.

From exozpurop.blob.core.windows.net

Property Tax Differences Between States at Alfredo Nowak blog Mclean County Il Property Tax Rate mclean county (2.31%) has a 9.5% higher property tax rate than the average of illinois (2.11%). What role does property tax play?. the median property tax (also known as real estate tax) in mclean county is $3,076.00 per year, based on a median home value. follow the link below to an overview of property taxes that will. Mclean County Il Property Tax Rate.

From exomilcil.blob.core.windows.net

Mclean County Illinois Real Estate Tax Bill at Christy Ryan blog Mclean County Il Property Tax Rate follow the link below to an overview of property taxes that will answer questions like: mclean county makes every effort to produce and publish the most current and accurate information possible. mclean county (2.31%) has a 9.5% higher property tax rate than the average of illinois (2.11%). tax rate which is the amount of tax due. Mclean County Il Property Tax Rate.

From ceofntit.blob.core.windows.net

Will County Illinois Property Tax Pin Number at Joyce Tillotson blog Mclean County Il Property Tax Rate tax rate which is the amount of tax due in terms of a percentage of the tax base is calculated by the county clerk's office. mclean county (2.31%) has a 9.5% higher property tax rate than the average of illinois (2.11%). mclean county makes every effort to produce and publish the most current and accurate information possible.. Mclean County Il Property Tax Rate.

From exomilcil.blob.core.windows.net

Mclean County Illinois Real Estate Tax Bill at Christy Ryan blog Mclean County Il Property Tax Rate tax rate which is the amount of tax due in terms of a percentage of the tax base is calculated by the county clerk's office. mclean county makes every effort to produce and publish the most current and accurate information possible. the mclean county collector’s office collects over $431 million in property taxes from approximately 68,000 parcels.. Mclean County Il Property Tax Rate.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Mclean County Il Property Tax Rate the mclean county collector’s office collects over $431 million in property taxes from approximately 68,000 parcels. to use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase. mclean county makes every effort to produce and publish the most current and accurate information possible. follow the link below. Mclean County Il Property Tax Rate.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Mclean County Il Property Tax Rate What role does property tax play?. mclean county (2.31%) has a 9.5% higher property tax rate than the average of illinois (2.11%). tax rate which is the amount of tax due in terms of a percentage of the tax base is calculated by the county clerk's office. Mclean county is rank 12th out. mclean county makes every. Mclean County Il Property Tax Rate.

From myemail.constantcontact.com

does your state impose high taxes? Mclean County Il Property Tax Rate mclean county (2.31%) has a 9.5% higher property tax rate than the average of illinois (2.11%). the median property tax (also known as real estate tax) in mclean county is $3,076.00 per year, based on a median home value. to use the calculator, just enter your property's current market value (such as a current appraisal, or a. Mclean County Il Property Tax Rate.

From koordinates.com

McLean County, Illinois Parcels Koordinates Mclean County Il Property Tax Rate mclean county (2.31%) has a 9.5% higher property tax rate than the average of illinois (2.11%). mclean county makes every effort to produce and publish the most current and accurate information possible. follow the link below to an overview of property taxes that will answer questions like: tax rate which is the amount of tax due. Mclean County Il Property Tax Rate.

From www.mapsofworld.com

McLean County Map, Illinois Mclean County Il Property Tax Rate mclean county (2.31%) has a 9.5% higher property tax rate than the average of illinois (2.11%). tax rate which is the amount of tax due in terms of a percentage of the tax base is calculated by the county clerk's office. What role does property tax play?. the median property tax (also known as real estate tax). Mclean County Il Property Tax Rate.

From www.bigfarms.com

Property For Sale Bloomington IL McLean County 78 Ac Bloomington Mclean County Il Property Tax Rate mclean county makes every effort to produce and publish the most current and accurate information possible. follow the link below to an overview of property taxes that will answer questions like: mclean county (2.31%) has a 9.5% higher property tax rate than the average of illinois (2.11%). What role does property tax play?. the median property. Mclean County Il Property Tax Rate.

From www.mcleancountyil.gov

Find Your Township and Range McLean County, IL Official site Mclean County Il Property Tax Rate follow the link below to an overview of property taxes that will answer questions like: the median property tax (also known as real estate tax) in mclean county is $3,076.00 per year, based on a median home value. the mclean county collector’s office collects over $431 million in property taxes from approximately 68,000 parcels. mclean county. Mclean County Il Property Tax Rate.

From exottiwas.blob.core.windows.net

How Much Is The Property Tax In Illinois at Ernest Green blog Mclean County Il Property Tax Rate mclean county makes every effort to produce and publish the most current and accurate information possible. the mclean county collector’s office collects over $431 million in property taxes from approximately 68,000 parcels. mclean county (2.31%) has a 9.5% higher property tax rate than the average of illinois (2.11%). Mclean county is rank 12th out. What role does. Mclean County Il Property Tax Rate.

From exomilcil.blob.core.windows.net

Mclean County Illinois Real Estate Tax Bill at Christy Ryan blog Mclean County Il Property Tax Rate tax rate which is the amount of tax due in terms of a percentage of the tax base is calculated by the county clerk's office. the median property tax (also known as real estate tax) in mclean county is $3,076.00 per year, based on a median home value. mclean county (2.31%) has a 9.5% higher property tax. Mclean County Il Property Tax Rate.

From www.stcharlesil.gov

Property Taxes City of St Charles, IL Mclean County Il Property Tax Rate tax rate which is the amount of tax due in terms of a percentage of the tax base is calculated by the county clerk's office. to use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase. follow the link below to an overview of property taxes that will. Mclean County Il Property Tax Rate.

From reggiqbathsheba.pages.dev

Illinois Property Tax Increase 2024 Janel Mclean County Il Property Tax Rate Mclean county is rank 12th out. tax rate which is the amount of tax due in terms of a percentage of the tax base is calculated by the county clerk's office. mclean county makes every effort to produce and publish the most current and accurate information possible. the mclean county collector’s office collects over $431 million in. Mclean County Il Property Tax Rate.

From crimegrade.org

The Safest and Most Dangerous Places in McLean County, IL Crime Maps Mclean County Il Property Tax Rate tax rate which is the amount of tax due in terms of a percentage of the tax base is calculated by the county clerk's office. to use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase. Mclean county is rank 12th out. mclean county (2.31%) has a 9.5%. Mclean County Il Property Tax Rate.